Wire and cable industry "12th Five-Year" will lift the tide of overseas mergers and acquisitions

Release time: 2021-12-31 18:00

"In the next five to 10 years, the wave of Chinese M&A, especially overseas M&A, will be increasingly turbulent." At the 9th Annual Conference of Chinese Enterprise Leaders held recently, industry insiders predicted that the pace of Chinese enterprises going overseas will accelerate significantly in the future.

Data show that in the first 11 months of this year, cross-border overseas mergers and acquisitions by Chinese companies accounted for about 11 percent of the total global M&A market, up 32 percent from the same period last year, with outbound M&A worth $47.3 billion. In total, Chinese companies bought 280 foreign companies for nearly $50bn.

Overseas mergers and acquisitions are on the rise

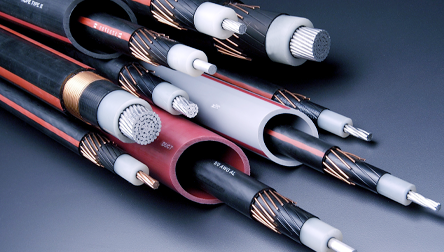

In recent months, news of overseas acquisitions by Chinese companies has been in the headlines. Sinopec's stake in Chevron's natural gas project in Indonesia; Bright Food Group to buy US health products company Jianansi for $2.5bn - $3bn; Shandong Gold invested 1.26 billion yuan in North and South American markets. Huaneng's acquisition of a 50% stake in American Electric Power; Tianjin Xinmao Group is paying 5 billion yuan to buy DRAKA, a Dutch fiber optic cable giant.

"The '12th Five-Year Plan' for industry mergers and restructuring is definitely an opportunity." Xu Lejiang, chairman of Baosteel Group, said the steel industry, for example, used to build new projects in the past two years, which resulted in a waste of resources and capacity. Now it needs to change its thinking in accordance with the policy and improve its core competitiveness more effectively through mergers and acquisitions.

"In recent years, the pace of overseas mergers and acquisitions by Chinese companies has accelerated significantly. "Iron ore, oil and other natural resource acquisitions, which are closely linked to China's economic growth, are overwhelmingly dominant." Michael Grown-qing, chief executive of Standard Chartered's investment banking unit in China, says he has helped Chinese state-owned enterprises make about 10 billion yuan worth of overseas acquisitions in the past two years, 80% of which were concentrated in the energy and resources sectors.

According to a recent report by Shanghai Securities Co LTD, overseas mergers and acquisitions in the non-ferrous metals and energy industries will become the mainstream of the next wave of Chinese companies going overseas. The "12th Five-Year Plan" puts forward the view that non-ferrous metals are mainly based on domestic demand. It is expected that mineral products, smelting products and primary processed products will be mainly oriented to restrain export, and the probability of raising or maintaining high tariffs is relatively high, while the highly processed products with high technology content will receive policy support. Therefore, overseas mergers and acquisitions and investment of non-ferrous metal enterprises will increase significantly, and the government will make full use of both domestic and foreign mineral resources and encourage enterprises to purchase overseas resources in policy.

"In the future, the domestic expansion of non-ferrous metal smelting enterprises is limited, so overseas mergers and acquisitions and investment will become an important choice for enterprises to expand." "The report said.

"It is fair to say that China has just begun to go global and must do so. In the next 50 years, if Chinese companies do not go global, the consequences are unimaginable. Take aluminum as an example. According to the current market situation in China, 50% of the world's aluminum is supplied by China, but China cannot make unlimited contribution to global consumption with its limited national resources. From this point, Chinese companies must go out and share global resources reasonably and legally with other countries." Alcoa Asia Pacific group president Jin Ya Chen said.

"At present, China has strictly controlled the export of 'two high capital' products, reducing the supply of raw materials to the global market. Looking at the development trend, after cutting off foreign trade channels, Chinese companies can only go out and make contributions to global resource consumption through overseas mergers and acquisitions." Ministry of Commerce Research Institute a researcher said.

Policy guidelines urgently need to be broken

"Although Chinese companies have a strong impulse to expand overseas, they don't have to be rich to go out. They also need to be qualified." Now, China plans to strengthen the management of overseas acquisitions by Chinese companies by issuing qualifications for overseas resource acquisitions, according to Shang Fushan, vice-president of the China Nonferrous Metals Industry Association.

Shang Fushan believes that the purpose of some Chinese companies acquiring overseas assets is not development, but speculation. Buy assets low and sell them high. Profit from overseas asset speculation. This not only disturbs the order of Chinese enterprises' overseas mergers and acquisitions, but also damages the image of Chinese enterprises abroad.

"The government encourages Chinese companies to expand overseas, but at the same time controls the hype of overseas mergers and acquisitions." According to Shang, "penny wise and pound foolish" have hindered Chinese companies' cooperation with the local community, as some companies have left a negative image in the region due to irregular ecological measures, lack of attention to environmental protection and safety and pursuit of short-term resource plunder after overseas resource acquisitions. He revealed that the Chinese government has completed the first draft of the qualification policy, whether central or local state-owned enterprises, even private enterprises will be subject to regulation.

"We have helped some Chinese companies with overseas mergers and acquisitions, and the results show that the key is not the amount of money spent, but the image of Chinese companies." ACapital Group chairman Andre said.

"China also wants to prevent speculative companies from damaging China's image while encouraging overseas mergers and acquisitions, and the most direct way is to speed up legislation." Mr Shang said more laws were needed to rein in companies that "go offshore" because of the chaos surrounding overseas mergers and acquisitions.

It is understood that in recent years, China's policies and legislation for enterprises to go global have been constantly improved, but most of the policies are mainly preferential and encouraging. Earlier, the Ministry of Commerce issued and implemented the Measures for the Administration of Overseas Investment and the Regulations on the Administration of Overseas Investment to encourage overseas mergers and acquisitions. Subsequently, the Ministry of Commerce, the Ministry of Finance, the National Development and Reform Commission and other relevant departments jointly formulated a number of supporting policies to support enterprises "going overseas", covering many aspects such as finance, taxation, finance, insurance, foreign exchange and entry and exit.

"In the overseas M&A cases of Chinese enterprises, many of them enjoy both favorable policies in China and overseas, which also strengthens the urge of these enterprises to 'go overseas'. However, more regulations are also needed for Chinese companies' overseas mergers and acquisitions to maintain China's image." Ministry of Commerce research Institute experts said.

Related News